Compound Interest: The Eighth Wonder of the World

When it comes to investing there are few variables more impactful than time. Life is busy and often times people tend to put off saving and investing for a range of reasons. I want to highlight the opportunity cost of the “I’ll get to it later” mindset.

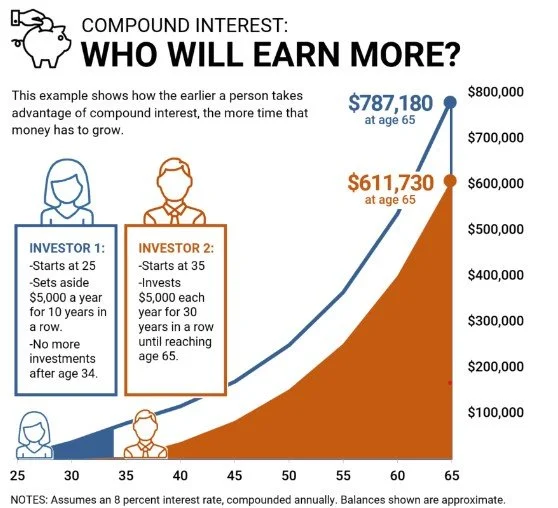

In the example graphic below, an 8% rate of return with a retirement age of 65 is assumed. Interest is assumed to compound annually.

A 25-year-old invests $5,000 every year for 10 consecutive years. After age 34, no additional investments are made and the money is left to grow until the investor reaches age 65.

A 35-year-old invests $5,000 every year for 30 consecutive years until retiring at age 65.

How much will each investor have at age 65?

The individual who started investing at 25 years old and made 10 total payments of $5,000 will end up with approximately $787,180 at age 65.

The 35-year-old who made 30 total payments of $5,000 will end up with approximately $611,730 at age 65.

Putting time on your side and investing earlier than later is one of the most impactful things one can do in accumulating wealth.