Market Returns During Recessions From a Historical Perspective

2022 so far has been a challenging year for the market and most asset classes. Even historically low volatility assets such as fixed income have performed negatively largely due to the impact of rising interest rates on bond prices. Having bonds and stocks experience negative returns at the same time is a historically rare event that is challenging many portfolios at the moment. Higher inflation levels than we’ve seen in years, continuing supply chain issues, rising interest rates, and the war in Ukraine have all contributed to considerable market volatility so far this year. There can be a lot of emotion involved when seeing all the negative headlines in the news and your portfolio value taking a significant hit. There have been a lot narratives of a looming recession and while we’re not officially in a recession yet, I think it’s helpful to explore the possibility that we could be in the not too distant future and what that could mean for the markets and your portfolio.

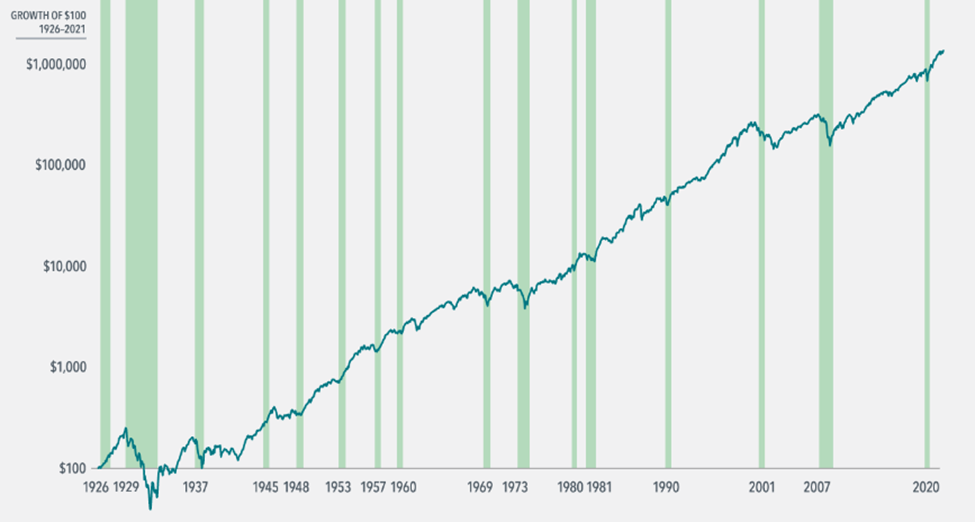

I’d like to provide some context from a historical perspective how the stock market has performed through the various economic recessions and bear markets during the last century. History tells us that most bear market environments do not last for long periods of time. The chart below highlights the growth of $100 in the US stock market represented by the “Fama/French Total US Market Research Index” from 1926 to 2021 while also highlighting periods of recession over that time period indicated by the green shaded areas. As you can see, market volatility is a largely normal aspect of the broad market and while there are periods of decline and sometime significant decline, long term investors have been rewarded historically for keeping their conviction and staying the course in volatile market environments.

Source: Dimensional Fund Advisors

While market declines can be scary and uncomfortable, they are often opportunities to get sidelined cash put to work in a globally diversified portfolio as valuation levels are largely more attractive due to recent selloffs. We don’t advocate attempting to “time” the market or wait for an ideal spot to get in because you may miss a significant portion of the ride in attempting to do so. However, when opportunities like this present themselves we are happy to take advantage of them. Markets around the world have often rewarded investors even when economic activity has slowed. This is an important lesson on the forward looking nature of markets, highlighting how current market prices reflect market participants’ collective expectations for the future.

In summary, while the news headlines and doomsday narratives can easily overwhelm, it can be helpful to look at past market behavior to understand that similar events have happened before. While history does not dictate future events and the fact that what is to come is largely unknown, putting current economic and market events into context can be helpful in calming one’s worries about their portfolio. Staying committed to your portfolio strategy is of paramount importance during market downturns to avoid locking in losses and sitting on the sidelines too long and missing the recovery as a result.

We at Borges Financial provide independent comprehensive financial planning and investment management for a flat fee. Reach out to us for a complimentary introductory call if you would like to explore our services further.